Salary Scales

Up to date salary scales are available on this link: https://www.ul.ie/hr/current-staff/pay-benefits/salary-information

OBTAINING A PPS NUMBER

A Personal Public Service (PPS) Number is needed in all dealings with Public Service Agencies. This is required for the University of Limerick to make payments to you.

You can apply for a PPS Number online at mywelfare.ie

In order to get a PPS Number, you must provide evidence of:

Once you obtain a PPS number you can then apply for Tax Credits.

TAX

To ensure the correct tax is deducted from your salary, you must apply online for a Tax Credit Certificate.

To do this, you need to register for myAccount. Once registered, you can register your UL employment by clicking on the 'Update Job or Pension Details' link under 'PAYE Services' section of the site.

The University of Limerick’s Employer Registration Number is 0032116A.

You should submit this as soon as possible to minimise the risk of Emergency Tax at 40%. Emergency Tax is applied in cases where your tax credits are unclear. If this is initially applied, the appropriate reimbursements will be made to you as soon as your tax situation is clarified.

The University of Limerick will be notified of your tax credits and will make appropriate salary deductions. Please contact salaries@ul.ie to confirm that they have received a Revenue Payroll Notification (RPN) to complete this.

If you have any queries on tax, the local tax office in Limerick is: Revenue Commissioners, Sarsfield House, Francis Street, Limerick, 01 7383636

OPENING A BANK ACCOUNT

As salaries are payable into a bank account chosen by a staff member, new members of staff who have not previously been resident in Ireland will need to open a bank account.

Required information for opening an account:

- Two forms of ID (passport/birth certificate/driver’s license)

- Proof of address (utility bill). If this is not available, some banks will accept a letter from Human Resources confirming employment with the University of Limerick. Please contact compandbens@ul.ie

Some useful information can be accessed on Citizens Information Opening a Bank Account

Pensions

The pensions website provides information on the University of Limerick Pension Schemes, together with details on Life Cover and other Group Schemes. The pensions team ensures that all staff who are members of the University of Limerick's Pension Schemes have accurate records of reckonable service and keeps all staff members well informed about all pension-related matters.

Pensions & Superannuation | University of Limerick (ul.ie)

SINGLE PUBLIC SERVICE PENSION SCHEME

OVERVIEW

The Single Public Service Pension Scheme (“Single Pension Scheme”) started on 1 January 2013.

If you joined the Public Service for the first time on or after 1 January 2013 and are working in a pensionable position, this is generally the Pension Scheme that applies to you.

Your Scheme is a Public Service Defined Benefit Pension Scheme.

The Single Pension Scheme is based on a career averaging model. This means that your retirement benefits are based on a % of your pensionable earnings throughout your public service career as a member of the Scheme.

Your retirement benefits are only payable at retirement if you have passed a vesting period. The vesting period for this Scheme is 24 months.

If you have paid pension contributions to the Scheme for less than 24 months overall and your employment is ending, you may apply to your employer for a refund of the pension contributions that you paid to the Scheme (less tax) if you are not taking up pensionable employment elsewhere in the Public Service.

If you receive a refund of your pension contributions, you surrender any benefits entitlement in the future under the Scheme.

Can I opt out of the Scheme?

No. It is generally a condition of employment that public service employees who are appointed to pensionable positions and meet the above criteria, and who are under 70 years of age on commencing pensionable employment, are required to join the Single Public Service Pension Scheme.

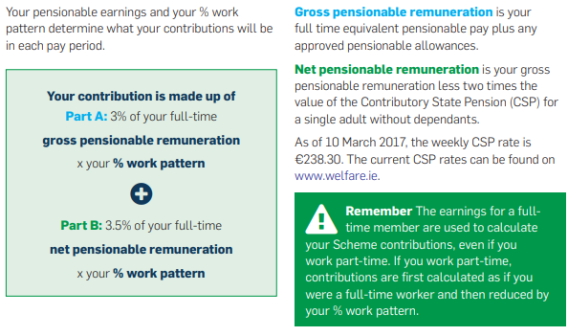

Your contribution is made up of

Part A : 3% of your full-time gross pensionable remuneration

plus

Part B : 3.5% of your full time net pensionable remuneration

Do I get tax relief on my contributions?

Your contributions are automatically deducted by your employer each time you get paid. Tax Relief on your contributions are given at source. This means that your gross pay is reduced by your contributions before PAYE (Pay As You Earn) tax is applied. You do not need to make a separate claim to the Revenue for tax relief.

Income Continuance Plan

The University of Limerick's Income Continuance Plan (ICP) provides financial security to members in the event of long-term absence from work due to long-term illness. ICP seeks to ensure that between Ill-Health Retirement Pension, any Social Welfare Disability Benefits and the University of Limerick Plan, members of the plan will receive a gross income of 75% of their pre-disability salary, should they suffer from a long-term illness.

Membership of this Plan became compulsory for employees of the University of Limerick on the 1st May 2009. Since this date, all new staff members who meet the eligibility requirements are automatically accepted into the University of Limerick Income Continuance Plan.

Disability Benefit In the event that your salary is affected because you are unable to work due to illness or injury, this Benefit aims to pay you an income of up to 75% of Salary after a certain period of time known as the deferred period

The total Plan premium is 0.66% of gross salary.

Your full Plan premium is eligible for income tax relief.

Income Continuance Plan & Additional Life Cover | University of Limerick (ul.ie)

Additional Life Cover

The University of Limerick's Life Cover Plan is designed to ease financial burdens at a difficult time, by providing a benefit to a member's dependents in the unfortunate event of their death, up to the value of 2.5 times their annual salary. This benefit is in addition to your cover as a member of the University of Limerick Superannuation Scheme/ Single Public Service Pension Scheme.

The premium rate is negotiated on a special “group basis” for employees of UL. The contribution rate with effect from 01 May 2015 is set at 0.53% of gross salary. Further information on the UL Additional Life Cover Plan scheme can be found here - ALC Information Booklet.

Additional Superannuation Contribution (ASC).

This is a charge on Public Sector Pay.

ASC applies to individuals who are accruing pensionable benefits in respect of their current employment.

ASC is applied via multiple tables (thresholds, bands, rates) ASC is charged at different rates with different exemption thresholds and bands depending on pension scheme and pension terms.