Getting any money back on your postgraduate fees is an appealing prospect, especially when it could be as much as €1,100. This is thanks to a special tax relief that Irish residents can claim on postgraduate tuition fees.

Claiming tax back on postgraduate fees is one of the best and biggest tax breaks you can get. Tax experts, Taxback.com, rank it among the top five most unclaimed reliefs in Ireland.

Claiming this relief can result in a tax deduction of up to €1,100. depending on how much your course fees are, the duration of your course (full-time vs part-time) and which tax year you make the claim. This is one of the biggest and least known advantages of when financing your postgraduate education.

You cannot claim relief for fees funded by grants, scholarships, or your employer. If you receive partial funding towards tuition fees, you must declare it to Revenue when you claim tax relief.

How to get tax back on master’s fees

With this tax relief, you can offset up to €7,000 paid in postgraduate fees against the tax you pay in that year (or, whomever is paying the fees can). This does not mean you get €7,000 back, but you will get 20% of €7,000 minus the ‘disregard amount’ set by Revenue for that year.

There are some conditions attached which will determine the exact amount of tax relief you will get (see more on this below).

The best part? This can all easily be done on ‘MyAccount’ on revenue.ie in a matter of minutes!

Benefits of claiming tax back on postgraduate fees

Postgraduate tax relief is not means tested, which is an excellent benefit for whomever is paying the fees, be they the student themselves, their families or a partner/couples. This means that anyone can apply for the relief once they have paid the fees, no matter what their income is.

Postgraduate fees tax relief can also be claimed on behalf of numerous students by the one taxpayer. This is particularly beneficial for families if several family members are pursuing postgraduate studies at the same time.

There are a number of ways to maximise this benefit as demonstrated in our example scenarios below. We also answer the most frequently asked questions people have about this type of tax relief.

Examples of how to claim tax back on postgraduate fees

Please note, these are not based on real people, they are merely examples to explain how the process works.

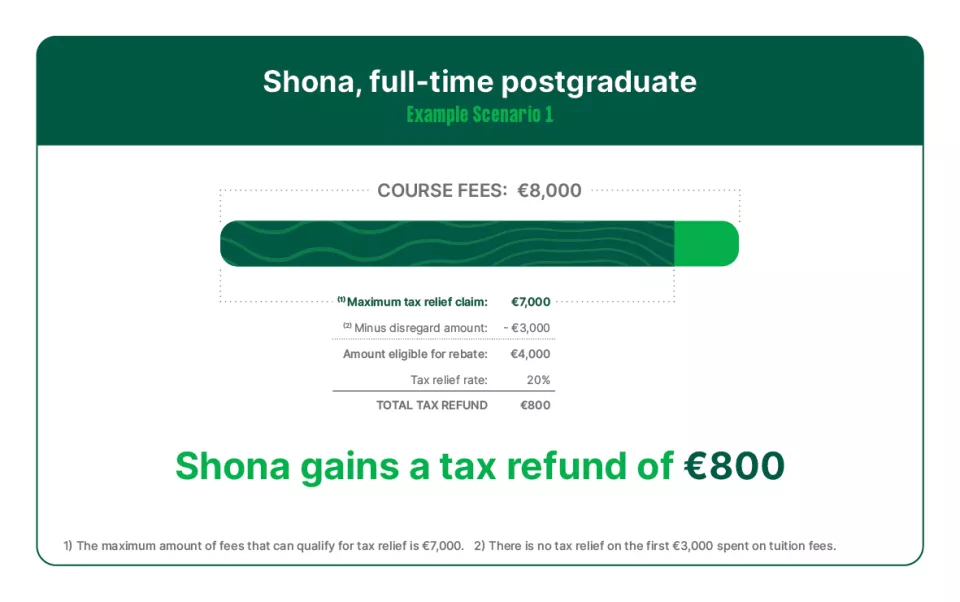

Example Scenario 1: Shona, a full-time postgraduate student

Shona starts a full-time postgraduate course at UL in 2021.

She pays fees of €8,000. The maximum amount of tax relief she can claim for is €7,000.

Shona must then also subtract the ‘disregard amount’ of €3,000 for full time Master’s fees.

| Fees | €8,000 |

| Maximum claim | €7,000

|

| Disregard | €3,000 |

| = | €4,000 |

Shona then claims tax relief in the current tax year, at 20%: 20% of €4,000 = €800.

Shona has been able to reduce her tax liability and gain a tax refund of €800.

Example Scenario 2: Brian, a two year part-time postgraduate student

Brian wants to claim tax back for his part-time postgrad that he will complete over two years.

He pays fees of €6,500 in instalments over the two years. Because he is paying over two years, he can claim relief on his Masters’ fees in two ways, either:

- in the tax year that the academic year commenced (September 2021)

or

- in the tax years in which he paid the instalment (2021 and 2022)

This is an example of where consideration should be given to an individual’s circumstances when claiming tax relief. If Brian claims relief for each tax year the instalments were paid in, he must subtract the disregard amount that applies to each year, i.e. the disregard amount is applied twice. But, if he claims relief in the tax year that the academic year commenced, there is only one calculation and the disregard amount only applies once, saving him hundreds of euro.

In Brian's case, it is more beneficial to claim in the tax year that the academic year began. This way he pays the fees over two years but only claims for one tax year.

The maximum fees amount you can claim for is €7,000 so Brian can claim for his full €6,500 fees. The disregard amount for part time courses is €1,500, which is deducted as follows:

|

Fees |

€6,500 |

| Maximum claim | €7,000

|

| Disregard | €1,500 |

| = | €5,000 |

He gets relief on this at 20%: 20% of €5,000 = €1,000

Brian gets €1,000 tax back.

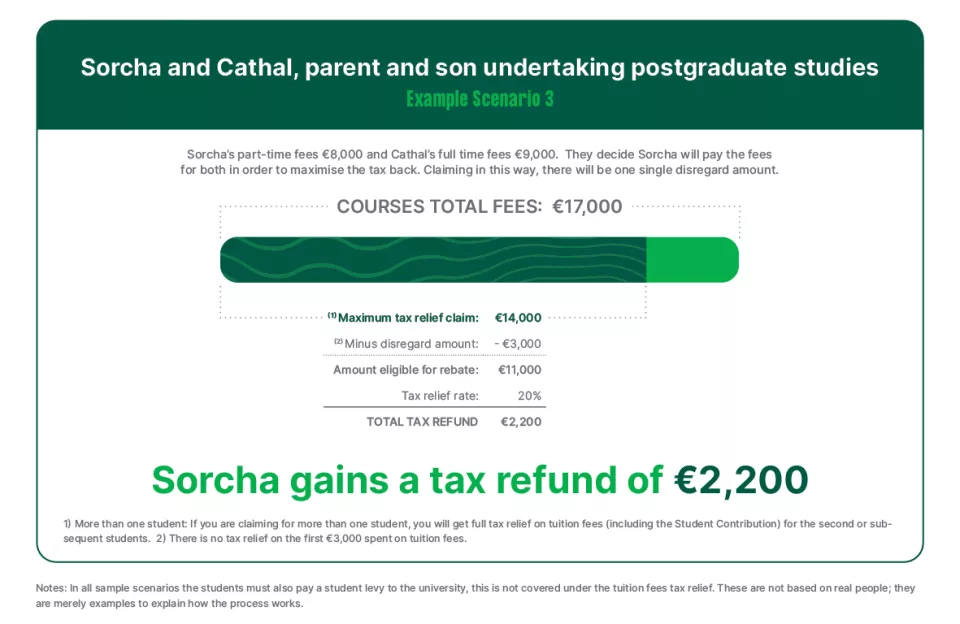

Example Scenario 3: Sorcha and Cathal, a parent and son undertaking postgraduate studies.

Cathal and Sorcha, and both want to return to college – full-time in his case and part-time in hers.

The cost of Sorcha’s postgraduate fees are €8,000 and Cathal’s fees are €9,000.

They decide that she will pay the Masters’ fees for both in order to maximise the tax they get back. This is because there will be one single disregard amount (if they both claimed separately, there would be two disregard amounts applied).

As the person who pays the fees, Sorcha makes the claim, which is restricted to a maximum of €7,000 per course.

However, she only has to subtract a single disregard amount for both courses.

Here’s how it works:

Qualifying fee for part-time course (Sorcha) €7,000 (max)

Qualifying fee for full-time course (Cathal) €7,000 (max)

Total: €14,000

Deduct one disregard amount €3,000 (you take the full-time disregard amount here)

Amount to claim tax relief on €11,000

20% of €11,000 = €2,200

Sorcha gets €2,200 tax back.

Sorcha and Cathal have maximised the tax relief for their postgraduate degrees by having one person pay for both fees and also by claiming tax relief in the tax year that the academic year commenced, saving €2,200.

Note –

In all the Example Scenarios the students must also pay a student levy to the university, this is not covered under the tuition fees tax relief.

How do I claim postgraduate fees tax relief?

Claims to get tax back on your master’s fees can be submitted during the tax year or after the tax year has ended. Tax relief can only be claimed where the person has a tax liability in the current year or has paid tax in a prior year. Any tax relief is limited to the tax liability/tax paid.

How you claim depends on whether you are an employee and pay tax through the Pay As You Earn (PAYE) system or if you are a self-employed person who pays their own tax through the self-assessment system.

If you are an employee in the PAYE system, you have a choice. You can either claim during the current tax year - or you can wait until after the tax year is ended on December 31st. Here’s how to do both:

1. Making a claim during the current tax year

You can make a claim in the current tax year to get tax back for your master’s fees once they have already been paid at the time of the claim. Current year claims will increase tax credits which will reduce the amount of tax you pay each time you get paid.

The quickest way to do this is online using the Revenue Commissioners ‘myAccount’ service. You do need an account to use the myAccount service.

The myAccount service makes sorting out your tax affairs more efficient as you can do this online. If you haven’t set up an account yet, it is simple to do so, just click here.

Once your account is set up, you can begin claiming your tax back for tuition fees.

Here’s how to claim tax relief for tuition fees:

- Sign into myAccount

- Click the ‘Manage your tax 20**’ link

- Select ‘Add new credits’

- Select ‘You and your family’ and ‘Tuition fees’.

Revenue understands that not everyone can use their online services, for example no broadband, where this is the case you can make a claim by printing and filling out a Form IT31 and sending it to your local Revenue office.

2. Making a claim after the tax year has ended

You can also make a claim after the tax year has ended. Claims made after the tax year has ended will reduce the tax liability for the year end, and, if the correct amount of tax was paid during the year, result in a refund (although a refund is not guaranteed).

Fill in the appropriate section when you complete your regular income tax return, as you would normally do each year. The quickest and easiest way to complete an Income Tax Return is by using PAYE Services in myAccount. You can do this by following these steps:

- Sign into myAccount

- Click the ‘Review your tax’ link in PAYE Services

- Select the Income Tax Return for the relevant tax year

- In the ‘Tax Credits & Reliefs’ page select ‘Tuition fees’

- Complete and submit the form

This form is available online in the Forms Ordering Service on the Revenue website. Form 12 or Form 12S are the relevant ones if you’re a PAYE employee. Form 12S simply incorporates the medical expenses claim form, if you want to conveniently claim two types of tax relief at the same time.

You can contact Revenue using the MyEnquiries facility on MyAccount of by calling the National PAYE helpline on 01 7383636, Monday to Friday (9.30am to 1.30pm), and they will post you any forms you need.

You can find the relevant one for you on the ‘Contact Us’ section of the Revenue website. Go to the individual’s section on the homepage, then the PAYE section and fill in your tax number. This function will return once the Revenue offices reopen.

3. How to apply if you pay tax under the self-assessed system

Self-assessed taxpayers need to fill out what is known as Form 11 every year. When doing so, simply complete the tuition fees section on the form.

How much can I claim back on postgraduate fees?

It depends on the type and cost of the course, but generally you can claim back 20% on fees of up to €7,000 minus the disregard amount. This may mean a maximum return of up to €1,100.

Can I claim tax relief on the full €7,000?

No. For full-time courses there is no tax relief on the first €3,000 spent on tuition fees and for part-time courses there is no tax relief on the first €1,500. This is known as the ‘disregard’ amount.

Who can I claim for and who claims the relief?

You can claim postgraduate fees tax relief for any student you have paid fees for – a relative and yourself for example. Tax back on Master’s fees can be claimed by whoever pays the fees, whether student, parent or other benefactor.

Can I get tax back for more than one postgraduate student’s fees?

Yes. There is no limit to the number of students claimed for by a single person - or postgraduate courses they study - provided you have paid the fees. Remember that the qualifying fee for each course is restricted to a maximum of €7,000 and a single disregard amount is applied to the entire claim.

You can claim for two of your children, for example, or you could claim for yourself and your spouse to maximise relief.

What if I pay for more than one student’s fees?

The disregard amount will only be deducted from your claim once. After you deduct the disregard amount for the first student, there is full tax relief on qualifying fees and payments for all subsequent students claimed for.

Please note, if all students are part-time the disregard amount will be €1,500. However, if ANY of the students you are claiming for are full-time disregard amount will be €3,000

How long does this process take? How soon do you get your tax relief back?

You can claim it in the current year if you have already paid the tuition fee(s). See below ‘How do I claim postgraduate fees tax relief?’ the steps are detailed below.

In the majority of cases, these claims are processed as quickly as possible. However, this depends on the individual circumstances – some claims take longer to process.

Which courses are eligible for postgraduate fees tax relief?

All courses provided by publicly funded universities in Ireland, including UL, are approved for the purposes of tax relief. You can check the list of approved courses on the Revenue website.

What if my course was covered by a grant or partially funded?

You cannot claim relief for fees that are funded by:

- grants

- scholarships

- your employer

Examples of these would include fees covered by the SUSI grant or government funded courses such as Springboard+ or Human Capital Initiative (HCI) courses.

If you receive partial funding towards tuition fees, you must declare it to Revenue when you claim tax relief.

Can I claim tax relief even if I pay the fees myself as a student?

Yes.

Is tax relief on postgraduate fees available only for tuition fees?

Yes. Examples of other charges and levies that do not qualify for the relief are:

- administration fees

- student centre levy

- sports centre charge

- USI (Union of Students in Ireland) levy.

Can I claim tax back on my Masters’ fees for more than one course?

There is no restriction on the number of courses you can include. But each postgraduate course is restricted to the maximum fees amount subject to a tax back claim of €7,000.

Do I need a receipt to claim tax back on master’s fees?

You do not need to submit receipts when you make your claim. However, making a claim for tax back on postgraduate tuition fees is the same as claiming for tax back on anything else so you will need a receipt or proof of payment. As with all receipts, you do have to keep them safe for up to six years as Revenue may request to view them at any time during that period.

For UL postgraduate students, there is a self-service receipt option available for all registered students on the Student Portal. Receipts can be generated at any time and for any date/academic year - an email will be sent with a PDF of the receipt to the student’s email address. These receipts should typically be available from the admissions or fees office at other universities.

Revenue Receipts Tracker app (RRTA) is the quickest and easiest option to save your receipt details or images, or both, to Revenue storage. You are not required to keep copies of paper receipts if you use Revenue storage. If you choose to keep digital copies on your own devices, you still have to keep the physical copies for 6 years.

Restrictions on claiming tax back on postgraduate fees

Maximum claim: €7,000 per course

Disregard: €3,000 for a full-time course; €1,500 for a part-time course

You can’t claim tax relief on expenses unless you pay for them. So, if your fees are paid by your employer or through a State grant, you can’t claim relief on those. You also cannot claim for the full €7,000 allowable against fees. Remember the disregard amounts that must be deducted first - €3,000 for full time post grad courses and €1,500 for part time courses.

Disclaimer: the information contained in this guide is provided for informational purposes only and should not be construed as taxation advice. Information is correct at the time of writing. Please check the Revenue.ie website for further information and updates. The University of Limerick accepts no responsibility for nor has control over the outcome of an individual’s tax relief or claim.

More support and information about funding your postgraduate course

We have two helpful guides with information about funding your future postgraduate studies at UL. The Budgeting for Your Future Guide is designed to take all of the stress out of your financial planning, clearly laying out a path for you to pay for your postgrad.

The Masters funding checklist guide provides information on scholarships, grants and other funding supports available at UL and elsewhere.