Core Portal - General - How to Add Dependants

To add dependants, log into your Core portal.

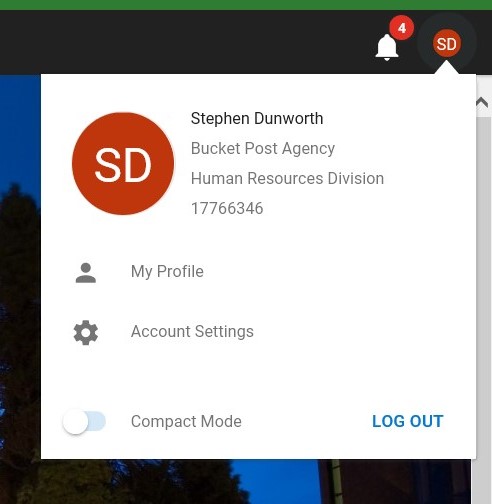

On the top right, click on your initials and click My Profile

This will bring you to a new screen with a menu on the left. Under Employee Detail, click Dependants.